Regional MIC branches in other regional cities will cease providing services as of March 31, 2024.

From April 1, 2024, MIC will continue to offer its core services in 📍Bratislava and 📍Košice.

For any inquiries, you can contact us through:

📧Email:

📞MIC Information Hotline: 0850 211 478 (reduced tariff calls only from Slovakia)

☎️ Phone: +421 2 5263 0023 (for calls from abroad)

We recommend using the email address 📧 for your inquiries.

Thank you for your understanding.

The revocation of extraordinary situation declared on 11 March 2020 in relation to COVID-19 is effective from 15th September 2023 onwards.

The extraordinary situation may be affecting your current authorisation to stay in Slovakia, the validity of your residence, the expiry of deadlines or the fulfilment of certain obligations. For an overview of the extraordinary situation rules, please visit our website HERE.

The end of the extraordinary situation may mean that you will have to leave Slovakia, apply for the renewal of your residence or fulfil an obligation towards the Foreign Police.

Please note: The revocation of the COVID-19 extraordinary situation does not affect the validity of the extraordinary situation declared in connection with the war in Ukraine. This state of emergency remains in force.

Part of MIC's activities within the framework of the Recovery and Resilience Plan of the Slovak Republic is also the provision of services for Slovak returnees (citizens of the Slovak Republic who plan to return or have returned to Slovakia from abroad) and their family members.

The range of services provided includes, for example:

Legal advice regarding:

- obtaining a Slovak marriage certificate if a Slovak citizen married abroad,

- obtaining a Slovak birth certificate for a citizen's child born abroad,

- acquisition of Slovak citizenship by a child born abroad,

- possibility of marriage to a foreigner,

- reacquisition of Slovak citizenship, if a citizen has lost Slovak citizenship,

- visas and residence permits for partners of Slovak citizens from abroad,

- conditions of access to the labour market for foreign partners of Slovak returnees, etc.

Labour and social counselling regarding:

- information on the recognition of education from abroad and the possibility of providing a financial contribution for the recognition of foreign education and professional qualifications,

- information about education and retraining and the possibilities of providing a financial contribution for an educational or retraining course,

- sociocultural orientation after returning from abroad,

- free Slovak language courses.

If you are considering returning to Slovakia and would like advice regarding the above (or other) situations, feel free to contact us.

IOM Migration Information Centre (MIC) activities supporting the labour mobility and integration of migrants under the Recovery and Resilience Plan of Slovakia are funded by the European Union – NextGenerationEU.

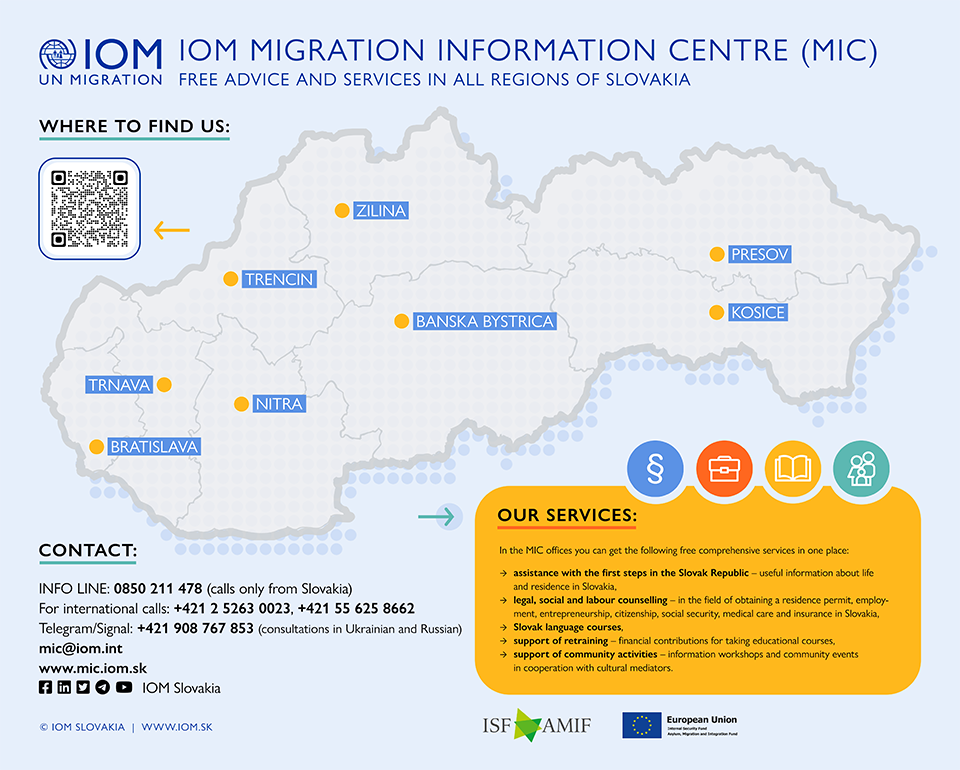

Visit the new offices of the IOM Migration Information Centre in 8 regions:

![]() BRATISLAVA - Grösslingová 35

BRATISLAVA - Grösslingová 35

811 09 Bratislava, Slovakia

![]() TRNAVA - Hlavná 29

TRNAVA - Hlavná 29

917 01 Trnava, Slovakia

![]() NITRA - Cintorínska 5

NITRA - Cintorínska 5

949 01 Nitra, Slovakia

![]() TRENČÍN - 1. Mája 173/11

TRENČÍN - 1. Mája 173/11

911 01 Trenčín, Slovakia

![]() ŽILINA - Framborská 58

ŽILINA - Framborská 58

010 01 Žilina, Slovakia

![]() BANSKÁ BYSTRICA - Dolná 54

BANSKÁ BYSTRICA - Dolná 54

974 01 Banská Bystrica, Slovakia

![]() KOŠICE - Floriánska 19

KOŠICE - Floriánska 19

040 01 Košice, Slovakia

![]() PREŠOV - Slovenská 65

PREŠOV - Slovenská 65

080 01 Prešov, Slovakia

Information about opening hours and how to contact us can be found HERE.

In the new IOM MIC branches, you can receive comprehensive services in the following areas at one place:

Legal advice and assistance:

- In the field of obtaining a residence permit, employment, entrepreneurship, citizenship, social security, medical care, insurance, etc.;

- Preparation of statements to administrative bodies;

- Information cards and brochures with up-to-date information for foreigners in the SR.

Employment and social counselling:

- Support in orientation in the labour market of SR;

- Assistance in finding a job, a resume (CV) / cover letter adjustment;

- Preparation for a job interview.

Support in the field of education and retraining:

- Providing financial contribution for taking individual training or retraining courses ;

- Free Open Slovak language courses ;

- Advice and financial assistance for the recognition of foreign education in Slovakia.

Cooperation with communities of foreigners:

- Organization of information seminars and community events in cooperation with cultural mediators.

If you have any questions, you can contact us at or HERE.

The information in this article is intended for citizens of a member state of the European Union, the European Economic Area (EEA) and the Swiss Confederation.

STAY OF EU CITIZEN

An EU citizen who stays in Slovakia for more than three months is obliged to request registration of residence within 30 days from the expiration of three months from the day of entry into the territory of the Slovak Republic. For information on the residence of EU citizens, reporting and registration of residence and basic obligations of EU citizens, click here.

STAY OF A FAMILY MEMBER OF AN EU CITIZEN

For information on the residence of family members of EU citizens who are citizens of non-EU countries, click here.

EMPLOYMENT

An EU citizen can be employed on the territory of the Slovak Republic without the need to obtain a work or other permit.

In the event that an EU citizen registers the residence of an EU citizen on the territory of the Slovak Republic on the basis of employment in Slovakia, he can attach an employment contract, a promise from the employer or a confirmation of employment from the employer to his application for registration of residence at the foreign police.

INFORMATION FOR EMPLOYERS OF EU CITIZENS

If you employ an EU citizen, you have the obligation to submit an information card on the establishment of an employment relationship to the relevant office of labour, social affairs and family within 7 working days of the worker's starting employment.

If the employment of an EU citizen has been terminated, as an employer you are obliged to submit an information card on the termination of the employment relationship to the relevant office of labour, social affairs and family within 7 working days from the termination of employment.

The relevant office of labour, social affairs and family is the office in whose territorial district the EU citizen will be employed.

Information cards can be submitted electronically through the central public administration portal slovensko.sk or by paper, either by submitting a completed form at the relevant labour office or by sending it by post.

BUSINESS

An EU citizen who is registered on the territory of the Slovak Republic is considered a Slovak person. In Slovakia, he can do business as a natural person - self-employed immediately after obtaining a trade license or as a natural person on the basis of a non-trade license according to special regulations. An EU citizen can also become a statutory body of a business company. For more information about doing business in the Slovak Republic, click here.

SOCIAL MATTERS

For information on health insurance in the Slovak Republic, visit our website here.

For information about the social insurance benefit, you can get our site here.

For information on Allowance, Child Care Allowance, Dependent Child Tax Credit, Child Benefit, Child Benefit and other family benefits, you can find our site here.

EDUCATION

Are you interested in learning the Slovak language? The Migration Information Centre offers free Open Slovak language courses. For more information click here.

CITIZENSHIP OF SR

In Citizenship, you will find information on the method of acquiring Slovak citizenship, the conditions for granting it, the necessary documents, and the procedure for granting Slovak citizenship.

CONCLUSION OF MARRIAGE

An EU citizen can marry a Slovak citizen on the territory of the Slovak Republic or abroad. More information can be found here.

OTHER USEFUL INFORMATION ABOUT LIFE IN SLOVAKIA

Didn't find the information you were looking for? Tell us more about it within the form below.

IOM Migration Information Centre (MIC) activities supporting the labour mobility and integration of migrants under the Recovery and Resilience Plan of Slovakia are funded by the European Union – NextGenerationEU.

Migration Information Centre IOM (MIC) within the Recovery and Resilience Plan of the Slovak Republic provides:

Migrant Support:

- Open Slovak Language Courses

- Employment Counselling

- Legal Advice

- Financial Contribution for Educational and Retraining Courses

- Financial Contribution for Recognition of Completed University Education from Abroad

Migrant Employer’s Support:

For employers planning to employ or already employing foreign nationals with higher qualifications in highly skilled positions, the MIC provides free legal counselling and training.

For more information

Employment of Foreign Nationals in Slovakia

If you are interested in specific online training, please contact us by email: .

Slovak Returnees Support:

MIC also provides its services to returnees - citizens of the Slovak Republic who live/lived abroad and who plan to return to Slovakia.

The above free services are available for the following groups:

- highly-qualified foreign nationals (with university degrees) from EU/EEA and non-EU/EEA countries and their family members,

- foreign university students with valid residence in the Slovak Republic studying at a university in the Slovak Republic and their family members,

- international researchers and talent from EU/EEA and non-EU/EEA countries and their families.

IOM Migration Information Centre (MIC) activities supporting the labour mobility and integration of migrants under the Recovery and Resilience Plan of Slovakia are funded by the European Union – NextGenerationEU.

From Thursday, 1 December 2022, you can find the IOM Migration Information Centre in Košice at the new address: Floriánska 19, 040 01 Košice, 2nd floor.

Route from the old address (Poštová st.) to Floriánska street:

As a citizen of Ukraine, I can stay in Slovakia for 90 days under the visa-free regime. I am not obliged to immediately apply for any form of international protection or temporary refuge, but I am obliged to report the address of my stay to the Foreign Police within 3 working days of entry to Slovakia.

A. I cannot work or run a business during my stay under a visa-free regime (90 days). I do not have public health insurance during this time.

B. If I have been granted temporary refuge (ODÍDENEC)

- I can work full-time or part-time, or work under an agreement on work performed outside the employment relationship, but I cannot run a business (or be self-employed).

- As an employee, I am insured with public health insurance, provided that I earn at least the minimum wage (In case I do earn less than minimum wage, I am only entitled to receive urgent medical care)

- I can work only on the territory of the Slovak Republic.

C. If I have been granted asylum or subsidiary protection (refugee status)

- I can work full-time or part-time, or work under an agreement on work performed outside the employment relationship. I can run a business;

- I do not need any additional work permit;

- I am insured with public health insurance;

- I can work and run a business only in the territory of the Slovak Republic.

D. If I have applied for asylum:

- For the duration of the crisis situation in Ukraine, me and my husband/spouse, we can work full-time or part-time, or under an agreement on work performed outside the employment relationship. However, we can not run a business. (this applies to me even if I am not a Ukrainian citizen in case I am a parent of the minor who is a Ukrainian citizen)

- As an employee, I am insured with public health insurance, provided that I earn at least the minimum wage (In case I do earn less than minimum wage, I am only entitled to receive urgent medical care)

- I can work only on the territory of the Slovak Republic.

Looking for a job

I can look for job offers through well-known job portals, which are now providing a special section for people arriving from Ukraine.

- Public job portal: sluzbyzamestnanosti.gov.sk

- Commercial portals: profesia.sk, kariera.sk, adeccojobsforukraine.com or worki.sk

In case I need assistance or counselling on labour market orientation, language education or requalification, I can find more information on the website of the Migration Information Centre.

The minimum wage in Slovakia is 750 EUR per month (gross). The average wage in Slovakia is 1 403 EUR per month (gross). I can look up an average wage for the concrete positions at platy.sk.

Necessary documents

The employer is obliged to report that he/she employs a foreigner, so I need to provide him with the following documents:

- If I am granted temporary refuge - the employer will make a copy of my passport (if I do not have a passport, a copy of any identification document) and a copy of the document confirming the temporary refuge (or a copy of the document confirming a tolerated residence);

- If I am granted asylum or subsidiary protection – the employer will make a copy of my travel document, foreigner’s travel document or foreigner’s passport and a copy of the residence card;

- If I have applied for asylum - the employer will make a copy of my asylum seeker ID card.

In most cases, no additional documents are needed to work in Slovakia. However, there are some professions where additional documents are required. These are, in particular, professions for which a certain education is required, the so-called regulated professions. For more information on the recognition of education, I can contact the Centre for Recognition of Diplomas. The extract from the criminal record register that is normally needed for the performance of the work in the public interest or for the pedagogical work, can be replaced with a declaration of honour.

Dangerous practice

I must be careful:

- if someone offers me a job without accurate information about the name of the company, place of work, work activity or salary;

- if someone offers me a job and asks me to hand over my travel document;

- if the employer does not sign an employment contract with me or the employment contract is written in a language which I do not understand;

- if someone offers me a job for which they will not pay me a salary, but only provide me with accommodation and food;

- if I am offered a job by an intermediary agency which wants me to pay a fee for the provision of the job.

In case I have doubts about the job offer or need advice, I can contact:

- International Organization for Migration – IOM: 0907 787 374

- National Helpline for Victims of Trafficking in Human Beings: 0800 800 818 (24/7)

If I want to learn more about how to safely look for a job and not become a victim of human trafficking, there is a page for me safe.iom.sk which is available also in Ukrainian language.

Other useful information can be found in the information leaflet of the Ministry of Labour, Social Affairs and Family of the SR.

If the employer does not pay me a salary, does not comply with the conditions agreed in the employment contract or infringes the Labour Code in any way, I can contact the relevant Labour Inspectorate or ask for free legal counselling:

- Lawyers of the Slovak Bar Association via email or by phone +421 911 175 387 (only persons coming from Ukraine due to military conflict);

- IOM Migration Information Centre via email or by phone 0850 211 478 (this line works only when calling from Slovakia), +421 2 5263 0023, + 421 55 6258662;

- Legal Aid Centre via email or by phone 0650 105 100.

Employee rights

In the labour market, I am guaranteed the same rights as an EU/EEA citizen, and I am therefore entitled to:

- the minimum wage – 750 EUR gross (approx. 649 EUR after payment of contributions to the health and social insurance fund and tax);

- 20 days of leave per calendar year (25 days if I am over 33 years of age or I will turn 33 in that year);

- Bonus payments for night work –1,724 EUR /hour, on Saturdays – 2,155 EUR /hour or 4,310 /hour on Sundays;

- the meal allowance if I work more than 4 hours during the day, otherwise it is the employer's responsibility to provide meals in a catering establishment);

- a rest period of 30 minutes if the work shift lasts longer than 6 hours;

- health insurance, which will provide me with free medical treatment in state facilities (some treatments are partially paid by the patient) and medicines prescribed to me by a doctor (it is partially paid by the patient);

- social insurance, which allows me to receive part of the salary (55% of the daily salary) in case of an inability to work (more than 10 days).

Termination of employment

The probationary period may be agreed for a maximum of 3 months. During this time, I can quit my job immediately and without giving any reason. During this period, my employer can similarly terminate the employment, immediately and without giving any reason. Termination of employment has no effect on the legitimacy of my stay in Slovakia.

After the end of the probationary period, the work is terminated by termination (if I work less than 1 year, the notice period is 1 month), by agreement or immediate termination of employment (in case of serious violation of professional discipline).

Working through the Agency

I am not supposed to pay any fee for being offered a job via a temporary employment agency.

The Agency shall assign me to work with the employer.

During the assignment, the salary is paid to me by the Agency.

The list of agencies that are authorised to assign employees can be found on the website of the Central Office of Labour, Social Affairs and Family where I can verify whether the agency has the necessary license. An agency without a license is not allowed to employ me.

Even if I work through the agency, my minimum rights (minimum wage, length of leave, etc.) are preserved.

Working in another EU/EEA country

- If I am granted temporary refuge in Slovakia, I can only work in Slovakia. If I decide to work in another country, I will first check the rules for entry and employment with the competent authorities in that country.

- If I am granted asylum or subsidiary protection in Slovakia, I can work in another EU/EEA country only if I obtain a work permit there.

- If I have applied for asylum which has not yet been decided, I must remain in Slovakia and cannot work in another EU/EEA country.

Subcategories

Novinky

Migračné informačné centrum IOM (MIC) poskytuje nasledovné služby:

- Otvorené kurzy slovenského jazyka pre cudzincov

- Finančný príspevok na vzdelávacie a rekvalifikačné kurzy

- Finančný príspevok na uznanie ukončenia vzdelania zo zahraničia

- Právne poradenstvo

- Sociálne a pracovné poradenstvo

- Podporu zamestnávateľov

Vyššie spomínané bezplatné služby sú dostupné pre nasledovné skupiny :

občanov krajín z krajín EÚ/ EHP a krajín mimo EÚ/ EHP, ktorí majú na Slovensku prechodný, trvalý alebo tolerovaný pobyt, vrátane žiadateľov o dočasné útočisko a osôb s udeleným dočasným útočiskom na Slovensku ("odídenci"),

- vysokokvalifikovaných cudzincov (s vysokoškolským vzdelaním) z krajín EÚ/ EHP a krajín mimo EÚ/ EHP a ich rodinných príslušníkov,

- zahraničných univerzitných študentov s platným pobytom na území Slovenskej republiky študujúcich na vysokej škole v SR a ich rodinných príslušníkov.